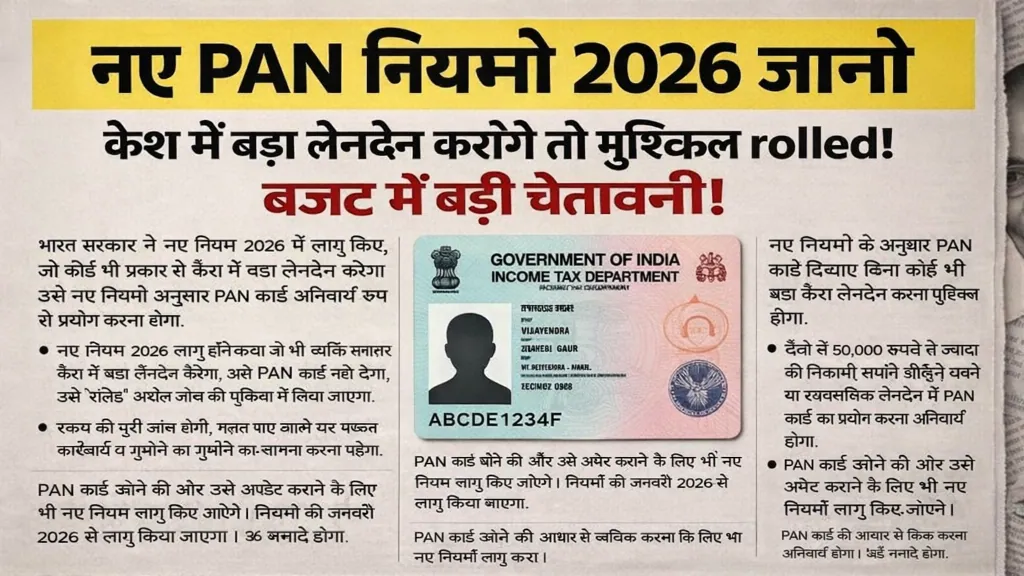

The Government of India has announced new PAN Card rules that will start from January 2026. These rules mainly focus on controlling large cash transactions and improving transparency in the financial system. If any person makes big payments in cash or does high-value business deals, PAN details will now be strictly required. The aim is to reduce black money and tax evasion. Young people, business owners, and salaried employees should understand these changes carefully to avoid penalties later.

| Topic | Details |

|---|---|

| Effective Date | January 2026 |

| Cash Limit | Above ₹50,000 PAN Required |

| Mandatory Linking | PAN-Aadhaar Compulsory |

| Penalty | Fine for Non-Compliance |

| Official Website | https://www.incometax.gov.in |

These updates are officially available on the Income Tax e-filing portal. Always verify information from the official website before making financial decisions.

1. PAN Mandatory for High Cash Transactions

From 2026, if you make cash payments above ₹50,000 in banks, property deals, shopping, or business transactions, showing your PAN card will be compulsory. Without PAN, the transaction may be stopped or reported.

2. Strict Monitoring by Authorities

The government will use advanced digital systems to track suspicious transactions. If someone frequently deposits or withdraws large amounts without proper records, it can trigger investigation. Transparency is the main goal.

3. PAN-Aadhaar Linking is Compulsory

If your PAN is not linked with Aadhaar, it may become inactive. An inactive PAN means you cannot file income tax returns, open bank accounts smoothly, or invest in financial schemes. Linking should be completed before the deadline.

4. Heavy Penalties for Non-Compliance

If a person fails to provide PAN details during high-value transactions, penalties can be imposed. In serious cases, legal action and fines may apply. Businesses accepting large cash payments without PAN records can also face trouble.

5. Impact on Business Owners and Freelancers

Small business owners, shopkeepers, and freelancers must maintain proper transaction records. Digital payments are encouraged because they reduce the risk of penalties. Maintaining transparency will help avoid future tax notices.

6. Increased Focus on Digital Economy

The government wants to promote digital transactions instead of cash deals. UPI, net banking, and card payments are safer and easier to track. This move supports a cleaner and more accountable financial system in India.

Overall, these new PAN rules are designed to create a transparent financial environment. Every citizen should update their PAN details, link it with Aadhaar, and avoid large unreported cash transactions. Being aware and responsible will save you from penalties and future financial problems.