At eighteen, I’m just starting to understand how important it is to invest early. The Post Office Public Provident Fund (PPF) feels like a safe and smart option for long-term savings. It helps build discipline by encouraging yearly deposits while offering steady interest. Even small amounts can grow over time. For students and young earners, this scheme is a reliable way to start creating financial security without taking big risks in the beginning.

Investment and Return Table Overview

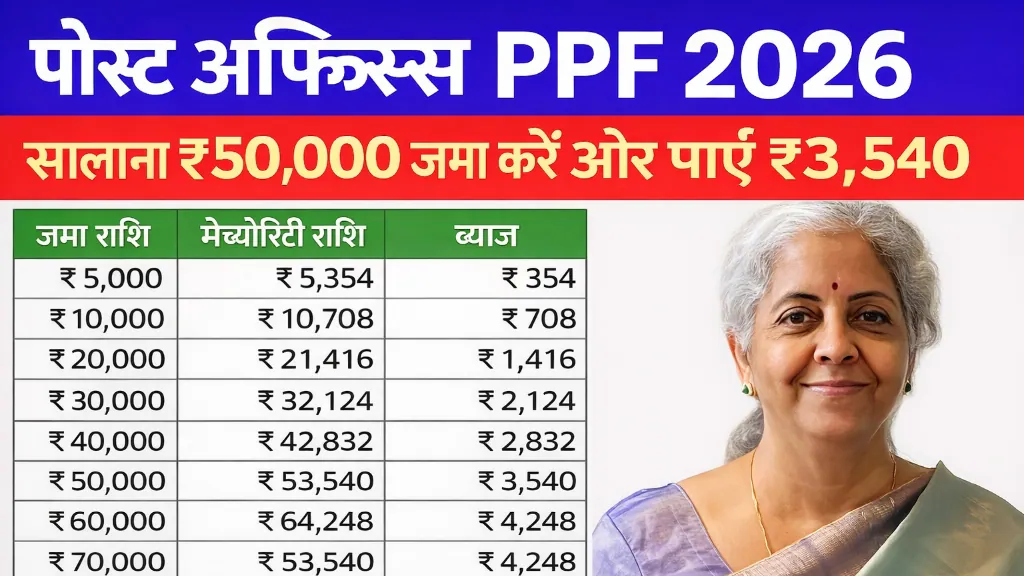

The table below shows how yearly deposits grow with interest in the Post Office PPF scheme. It clearly explains maturity amounts and earned interest. For official and updated details, always check the government website: https://www.indiapost.gov.in

| Deposit Amount | Maturity Amount | Interest Earned |

|---|---|---|

| ₹5,000 | ₹5,354 | ₹354 |

| ₹10,000 | ₹10,708 | ₹708 |

| ₹20,000 | ₹21,416 | ₹1,416 |

| ₹30,000 | ₹32,124 | ₹2,124 |

| ₹40,000 | ₹42,832 | ₹2,832 |

| ₹50,000 | ₹53,540 | ₹3,540 |

Safe and Government Backed Investment

The biggest advantage of the Post Office PPF scheme is safety. It is backed by the Government of India, which makes it one of the most secure investment options available. At eighteen, I don’t want to risk my hard-earned money in unstable markets. PPF gives peace of mind because returns are stable and protected. There is no tension about sudden market crashes or losses. This security makes it perfect for beginners who are just starting their financial journey and want guaranteed long-term growth.

Attractive Interest with Compounding Benefit

PPF offers attractive interest compared to regular savings accounts. The best part is compound interest, which means interest is earned not only on the principal amount but also on previous interest. Over many years, this creates powerful growth. Starting early at eighteen gives more time for compounding to work. Even if I invest a small amount now, it can turn into a large amount after 15 years. Time is the biggest advantage for young investors.

Long Term Wealth Creation

PPF has a lock-in period of 15 years, which helps build disciplined savings habits. Instead of spending money unnecessarily, I can invest regularly and focus on future goals like higher education, starting a business, or buying a home. Long-term investment teaches patience. It prevents quick withdrawals and supports steady wealth building. For young people, this is a great way to secure the future without depending only on salary income.

Tax Benefits Under Section 80C

One of the major benefits of PPF is tax savings. Investments up to a certain limit qualify for deduction under Section 80C of the Income Tax Act. Also, the interest earned and maturity amount are tax-free. This makes PPF an EEE (Exempt-Exempt-Exempt) investment option. For young earners who start paying tax early, this scheme helps reduce tax burden legally while growing savings at the same time.

Flexible Investment Amount

PPF allows a minimum yearly investment of ₹500 and a maximum of ₹1.5 lakh. This flexibility is helpful for students and beginners. If income is low, I can invest a smaller amount. If I start earning more, I can increase my contribution. This makes the scheme suitable for different financial situations. It does not pressure investors but encourages consistent saving habits.

Loan and Partial Withdrawal Facility

Although PPF has a long lock-in period, it still provides some flexibility. Loans can be taken against the PPF balance after a few years. Partial withdrawals are also allowed under certain conditions. This ensures that money is not completely stuck in emergencies. For young investors, this feature adds financial support without breaking long-term savings goals.

Conclusion

Starting investment at eighteen through the Post Office PPF scheme is a smart financial decision. It offers safety, steady growth, tax benefits, and long-term security. By investing regularly and patiently, I can build a strong financial foundation for my future and achieve my life goals confidently.